This pattern is symmetrical, having equal lengths of upper as well as lower shadows. However, the main body of the spinning top candlestick is small in length, which means only a marginal difference between the opening and closing prices of a security. As a neutral candlestick pattern, the spinning top can be formed in charts in different scenarios.

If the prices reverse, the trader would most likely have bought the stocks at the lowest prices. The Spinning Top candlestick pattern is formed by one single candle. With this bearish setup example, a sell order was placed a few pips below the red confirmation candle’s low and a stop-loss order was placed a few pips above the spinning top’s high. A target was again placed at a level that offered double the reward versus the risk taken on this trade setup. The spinning top forex pattern that appeared on the far right of this chart, however, led to the strongest decline after the RSI line went into an overbought condition. Another strong indication that price was likely to decline was when bearish divergence showed up between the previous high and the higher high of this market.

Confirming spinning top patterns

As sellers enter the market, the share price starts moving, hitting a low of 430p. Buyers start to push back, and the share price reaches a high of 455p before the market settles and the share price closes at spinning top candlestick pattern 445p. This creates a bullish spinning top candlestick, as pictured below. The spinning top candlestick is an easy formation to recognise and can be helpful in determining whether a price reversal might occur.

Alibaba Unveils Its Spin-Off Plans – MarketBeat

Alibaba Unveils Its Spin-Off Plans.

Posted: Wed, 31 May 2023 12:19:42 GMT [source]

ThinkMarkets ensures high levels of client satisfaction with high client retention and conversion rates. Harness past market data to forecast price direction and anticipate market moves. We have members that come from all walks of life and from all over the world. We love the diversity of people, just like we like diversity in trading styles. We want you to see what we see and begin to spot trade setups yourself.

What Is a Spinning Top Candlestick?

After all, neither buyers nor sellers currently have the upper hand. Candle B is a white spinning top that appears in an upward price trend. Price breaks out

upward from this spinning top two days later, meaning the spinner acted as a continuation of the up trend.

Nothing in this material is (or should be considered to be) financial, investment, legal, tax or other advice and no reliance should be placed on it. As we can see, the spinning top candlestick appears at the key Fib level of 50% – giving further strength to the bearish signal. Because of this, most traders hold off confirming what the market might do next.

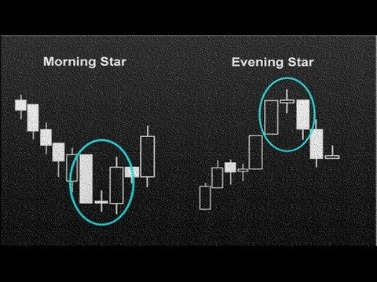

How to trade a Morning Star candlestick pattern?

They aren’t very helpful as a standalone indicator given their frequency and lack of predictive accuracy. But after adding trend lines, they become a helpful confirmation for a reversal. Spinning tops aren’t a very reliable technical indicator in isolation.

- After confirming the upcoming reversal, the trader may proceed and select either the buy or sell option in the trading ticket.

- If you look at a spinning top in isolation, it does not mean much.

- Spinning top candlesticks are found on stock charts and could be a bullish or bearish reversal sign.

- As with most candlestick patterns, technical traders will often use additional confirmation methods to help them identify the patterns that may lead to the best trading opportunities.

- The stock then broke above the high of the candlestick and began the next leg higher.

As per analysts, the spinning candlestick means that the current trend may be fizzing out and chances of trend reversal increasing. Learn the exact chart patterns you need to know to find opportunities in the markets. In this chart, we have the perfect combo to enter a short-selling position – that is, spinning top pattern, double top pattern, and the intersection at the 61.8% Fibonacci level.

Example of a Spinning Top Candlestick

HowToTrade.com takes no responsibility for loss incurred as a result of the content provided inside our Trading Room. By signing up as a member you acknowledge that we are not providing financial advice and that you are making the decision on the trades you place in the markets. We have no knowledge of the level of money you are trading with or the level of risk you are taking with each trade. In the USD/CHF chart below, we can see how the bullish spinning bottom pattern is formed at the end of a downward trend. As a confirmation, we used Fibonacci retracement levels drawn from the lowest level to the highest level of the previous trend. On the other hand, if you spot a spinning top on a rangebound market it can signal a continuation of the consolidation.

- However, to verify the prediction, as aforementioned, the candle that comes next after the spinning top candlestick is crucial in confirming the new trend direction.

- It can also signal a possible price reversal if it occurs following a price advance or decline.

- It is another common and effective candlestick reversal pattern used by forex traders to find trading opportunities and market trends.

- Harness the market intelligence you need to build your trading strategies.

Spinning Top candlesticks usually have small bodies with upper and lower shadows that exceed the length of the body. Therefore, a spinning topper is often confused with a doji pattern. The only difference between the two is that the Doji pattern opens and closes at the same point. Another difference is that the doji is typically a sign of reversal.

Spinning Top Candlestick: Meaning, Example, Limitations

The only difference between the two is that a spinning top has a short body, whereas a long-legged doji has no body whatsoever. Spinning top candlestick is a pattern with a short body between an upper and a lower long wick. The spinning top illustrates a scenario where neither the seller nor the buyer has gained. In this article, I will discuss how to combine spinning tops with other candlestick formations and volume candles to pinpoint market reversals and continuation patterns. Before we dive into the details of the setups, I first want to ground you on the construct of a spinning top.

Spinning top is a Japanese candlesticks pattern with a short body found in the middle of two long wicks. The upper and lower long wicks, however, tell us that both the buyers and the sellers had the upper hand at some point during the time period the candle represents. Spinning top candlesticks are found on stock charts and could be a bullish or bearish reversal sign. A spinning top candlestick is a sign of indecision in the market. However, this doesn’t come as a surprise because it’s apart of the doji candlesticks family. It has a thicker real body and could also be found in consolidation areas.

How to Identify a Spinning Top Candlestick Pattern

For example, suppose that a stock you’re watching is forming a double bottom, which suggests that a bullish reversal may occur. You may look for a spinning top at the second bottom to confirm that the reversal is likely to occur. If there’s a bearish candlestick instead, you may not be so confident. We also offer real-time stock alerts for those that want to follow our options trades. You have the option to trade stocks instead of going the options trading route if you wish. The Bullish Bears trade alerts include both day trade and swing trade alert signals.

Recent Comments